Expect Six More Interest Rate Increases This Year

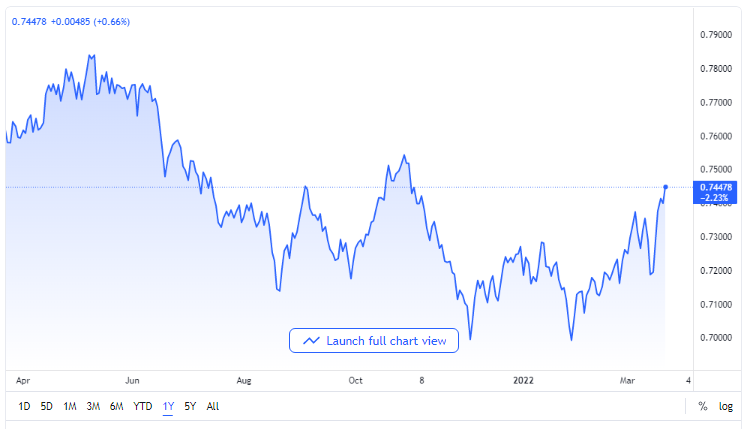

The AUD/USD currency pair has fallen sharply on Tuesday but sustained itself above 0.7400 in response to the Federal Reserve’s declared aggressive policy stance and roadmap for the rest of this year in order to tame the stubbornly high and continuously rising inflation rate.

The Federal Reserve has stated openly that there would be additional six interest rates increases in the course of this year. Each one will come at each of the reserve’s remaining monetary policy meetings for 2022. Federal Reserve policymakers have resorted to elevating interest rates as a last resort to rein in the skyrocketing inflation.

AUD/USD price chart. Source TradingView

Over the soaring inflation, the Chicago Mercantile Exchange’s FedWatch Tool has given up to 60% possibility for a 50 basis points rise in interest rates in the Federal Open Market Committee meeting scheduled for May.

What to Expect When

In the meantime, financial giant, Goldman Sachs in its round of analysis said that it clearly sees about two 50 basis points increases which will start with the coming Federal Open Market Committee meeting of May and June. The firm says that these two 50 basis points increases would then be followed by four 25 basis points increases which would usher the market into the end of the year. Goldman Sachs equally says that it sees the interest rate increase to 2% by the time the year ends.

On the other hand, the US dollar index is doing good numbers on Tuesday as it soared to higher by 0.36%. The dollar index has seen a number of major bids when it passed over 98.00 from the point it had experienced a lot of resistance many times before.

The statement delivered by the Governor of the Reserve Bank of Australia, Philip Lowe, did not succeed in strengthening the fiat currencies in the Australian continent as there is a need for more proof from the administration to show that there is a general price pressure that will necessitate a move for policy fastening.

The speech that is expected to be delivered by the Federal Reserve’s Chair, Jerome Powell, on Wednesday is a significant event being looked out for by the market this week as it is likely to give further insight into what traders should watch out for in the event that the Feds go ahead with another rate increment in May