Interest Rates Remain Same

The pair of AUD/USD has climbed with so much strength neat 0.7700 as the Reserve Bank of Australia has decided to keep the country’s interest rates steady at 0.1%. Early in the Asian session on Tuesday, the pair were already consolidating in a very tight range of between 0.7536 and 0.7548.

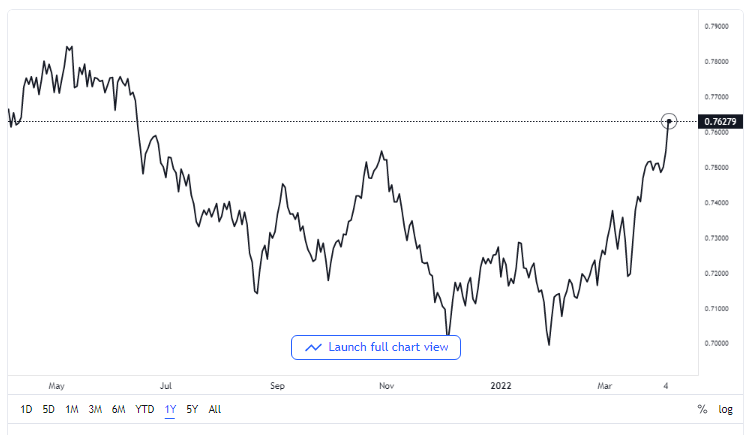

AUD/USD price chart. Source TradingView

It was widely expected that the Reserve Bank of Australia was going to leave the country’s monetary policy unchanged and that the bank was going to maintain its dovish position as global inflation rates keep climbing to new heights while the growth rate is not moving at a proportional rate due to the ongoing war in Ukraine.

During the monetary policy meeting of the reserve bank in the month of March, the bank’s Chair, Philip Lowe, stated that the market should get ready for the maximum of ten basis points in the interest rate this year just to control the rising inflation and to stem its effect on the Australian economy. Policymakers at the Reserve Bank of Australia are not seeing any pressure in price that should force the bank’s hand into increasing interest rates. Likewise, events in the labor market for soft skills are not letting any need to increase lending rates.

More Funds on Price Increase

The Australian dollar has been performing very well against the US dollar for some trading sessions now as commodity prices have been rising without stopping. As a major exporter of food products, energy, iron ore, and other forms of base metal, Australia has witnessed a higher inflow as a result of increased prices of commodities.

Whereas, the US dollar index has surpassed the expected resistance figure of 99.00 in the midst of reactions to the upbeat employment report in the United States. There was a shrugging off of the low numbers that accompanied the US non-farm payroll by investors, and it is underpinning the slippage seen in the rate of unemployment.

The United States unemployment rate came in at 3.6%, below what the market consensus was at 3.7%, and the initial numbers at 3.8%. The figures have further increased the possibility that the Federal Reserve is going to increase interest rates by 50 basis points at each of its next two meetings, with the first one coming in May.

The ongoing war in Ukraine is also playing a significant role in directing market sentiments. All hopes lie in diplomats reaching a ceasefire agreement between the two warring sides.