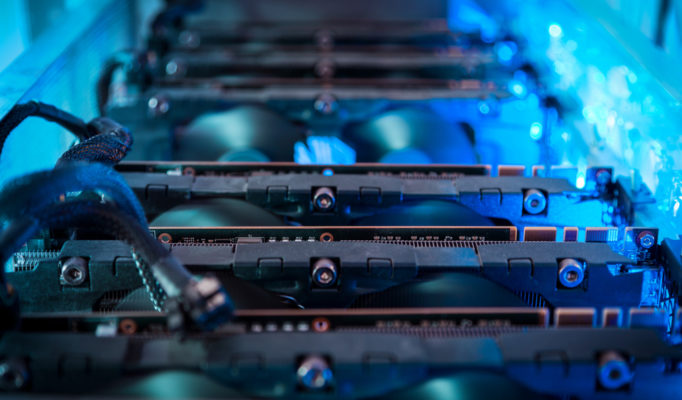

Crypto lender BlockFi Inc. was previously declared bankrupt. Now it wants to sell over $160 million in debts that are backed by almost 68,000 Bitcoin mining rigs.

The New Jersey-based company asked for protection from its debtors in November of last year. This started a bidding process for the debts.

A few of the loans have been late before. Given how much Bitcoin mining equipment costs now, they don’t seem to have enough collateral.

BlockFi struggled after the failure of FTX in November and the failure of Three Arrows Capital in 2022 respectively.

BlockFi went bankrupt right after FTX. It was the first on a list of failed businesses that were asking customers for their money back.

The business is now trying to get the money back. The business failed and attempted to get money back.

BlockFi is currently situated in the same location and has the same goals in mind.

Blockfi’s Downfall

In November, BlockFi, a company that lent money in cryptocurrency, filed for bankruptcy. After the most recent disaster in the crypto sector.

The company was hurt by its exposure to the collapse of the FTX exchange.

In a bankruptcy petition, BlockFi’s founder said that the company’s lack of cash flow was due to its large amount of exposure to FTX.

The man who created FTX, Sam Bankman-Fried, filed for bankruptcy in the United States at the beginning of the previous year. In just three days, traders withdrew a total of $6 billion from the site.

Mark Renzi, MD of Berkeley Research Group, says that FTX exposure is a major factor in cases of bankruptcy. Debtors don’t worry about the same things that FTX does. Even though the debtors don’t seem to have the same worries that FTX does.

BlockFi said that the liquidity situation was okay because it had loans to Alameda, a crypto trading business that was connected to FTX.

Mining-Machine-Backed Blockfi Loans

BlockFi is now able to assist individuals who are interested in purchasing mining rigs in obtaining loans backed by 68,000 of those rigs. An announcement was made relatively recently by the company.

As a result of the decline in the cost of mining machinery, the collateral offered for a loan of 160 million dollars is most likely insufficient.

As was the case last year, mining rigs that make less than 38 J/Th are worth $98. Its value has decreased by approximately 90%, and it is only worth $9.9 at this point.

The crash of the market for cryptocurrencies was the direct cause of this unexpected decrease in value. The decrease in the price of Bitcoin (BTC) as well as higher operating costs, such as higher bills for electricity.

Even though traditional lenders stayed away from the cryptocurrency market because it was so volatile. The companies like BlockFi still gave money to the mining business.

Celsius Sells Miners

As BlockFi sells loans backed by Bitcoin mining machines. It was found that Celsius Network, another crypto lender, was running a similar but different business.

Instead of giving out loans, Celsius Network has told the public that it is selling its mining equipment.

The company that did crypto financing filed for bankruptcy on January 13. Its mining division said it would sell about 2,687 pieces of Bitcoin mining equipment to an investment group called Touzi Capital.

Alex Mashinsky served as both the CEO and founder of the loan company that ultimately went bankrupt. Letitia James, the Attorney General for the state of New York, filed a lawsuit against him at the beginning of this month.

The Attorney General says that the CEO of the company scammed tens of thousands of clients.

The crypto industry seems to be getting more and more volatile every day, which increases uncertainty.

Investors and crypto experts are worried about the effects of large crypto-based business failures on crypto market prices. Worries about how it will affect the market.