Decentralized applications (dApp) activity has increased two-folds in Q3 2020. Tron and Ethereum are top platforms on which dApp and DeFi activities are highest while the EOS network is far below.

Ethereum Is Leading in DeFi Growth

Ethereum has gained a high reputation as top DeFi projects and decentralized exchanges (DEXes) choose Ethereum over other platforms. So, it has outperformed even Tron and EOS in smart contracts. The daily wallets activity has surged by 150% in Q3 as compared to Q2 thanks to DeFi, exchanges, and marketplaces.

The activity reached to peak after the launch of the UNI token on Uniswap. Per recorded data, users’ activity on decentralized exchange Uniswap has increased 376% in Q3 2020. NFT token is the latest one which is accepted by the crypto community open heartedly. The activity on platforms for NFT tokens has surged by 475% during the quarter.

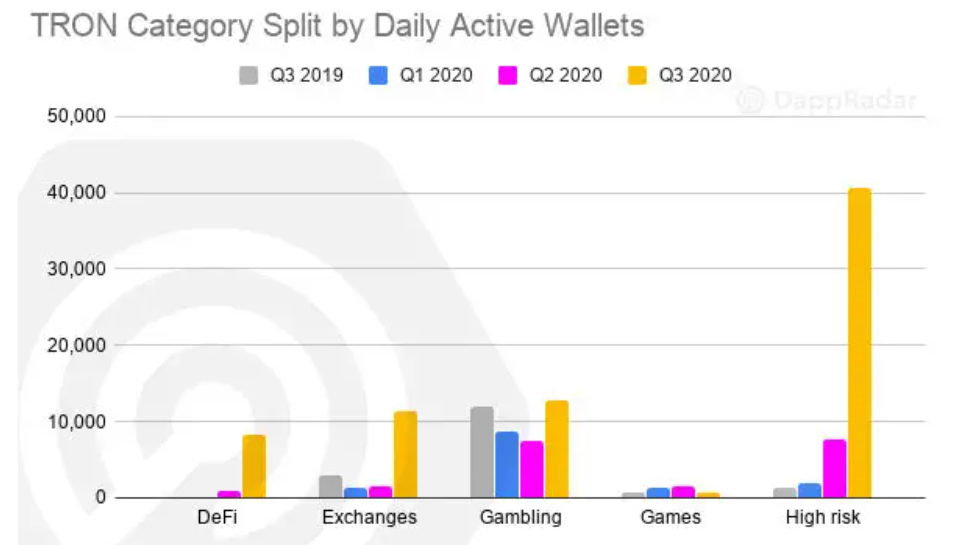

Tron Overtakes Ethereum in “high-risk” Category

Tron network has made significant progress after it introduced Tron 4.0 in July. It takes lead in the dApp activity but for only those which fall in the “high-risk” category such as gambling apps. However, no one can deny that it has also shown significant growth in DEX and DeFi.

EOS, on the other hand, remains at the third spot after Ethereum and Tron. EOS has witnessed only 34% growth since the beginning of 2020. Even the DeFi craze in the crypto space has not stimulated the growth of the network.

DeFi has become a favorite investment in the crypto space as billions of dollars are now locked in different DeFi protocols. The trading volume of decentralized exchange Uniswap has increased many folds. Uniswap is now the most popular among the decentralized exchanges as it has shown a parabolic growth in the last three months. According to UNI’s allocation document:

“A community-managed treasury opens up a world of infinite possibilities. We hope to see a variety of experimentation, including ecosystem grants and public goods funding, both of which can foster additional Uniswap ecosystem growth.”