The Euro Stays Bullish

The Eurozone’s flash Purchasing Managers’ Index came in weaker than the forecasts had. But the poor survey did not deter bulls of the Euro during trade on Tuesday. This was because it still showed a solid growth underneath unlike its UK counterpart.

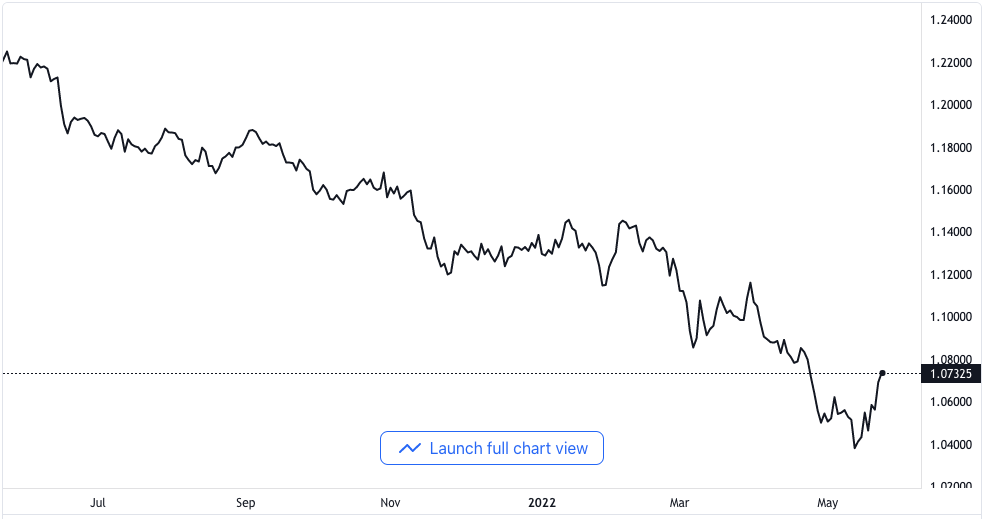

The Purchasing Managers’ Index showed growth in spite of unabated high inflation rates. Indeed, the EUR/USD pair was able to recover the 1.0700 area as it got propelled. The tailwind of the pair came from hawkish commentaries within the European Central Bank.

EUR/USD price chart. Source TradingView

At the present levels of 1.0710-20, the EUR/USD trades with about a 0.25% gain daily. Its weekly gain is, thus, rising to about 1.5%.

As a refresher, the President of the ECB said the bank might increase interest rates. The rates would be going into positive areas by the end of the third quarter. Christine Lagarde reiterated this position in a statement made on Tuesday.

Other high-level policymakers in the European Central Bank throw their weights behind Lagarde. They include the Governor of the Bank of France, Francois Villeroy de Galhau. Although some hawkish ECB members are reportedly angry about the removal of 50 bps.

Split Among ECB Hawks

There are reports that Lagarde and some core members of the ECB did away with the possibility of a 50 basis point rate increase. The Governor of Austria’s Central Bank, Robert Holzmann, pushed for a 50 bps increase in July.

Even though hawks are not satisfied, the Euro currency bulls are. The EUR/USD currency pair is almost 3.5% higher than its earlier print in the month. It was initially at 1.0300. While it currently defying analytics calls for it to hit parity in coming weeks.

The pair’s latest increase also comes in spite of continuous sentiments in the stock market. It should normally be a headwind since the US Dollar receives safe-have inflows.

The pair is currently looking at testing its 50-period daily moving average in the 1.0760 area. Strategists are equally questioning how the current rebound has to go.

The hawkish shift from the Federal Reserve has been the main driver of gains in the US Dollar. Comments from Fed top officials in the past week show they are just getting started. Jerome Powell is scheduled to speak in the American session.