ECB Goes Dovish

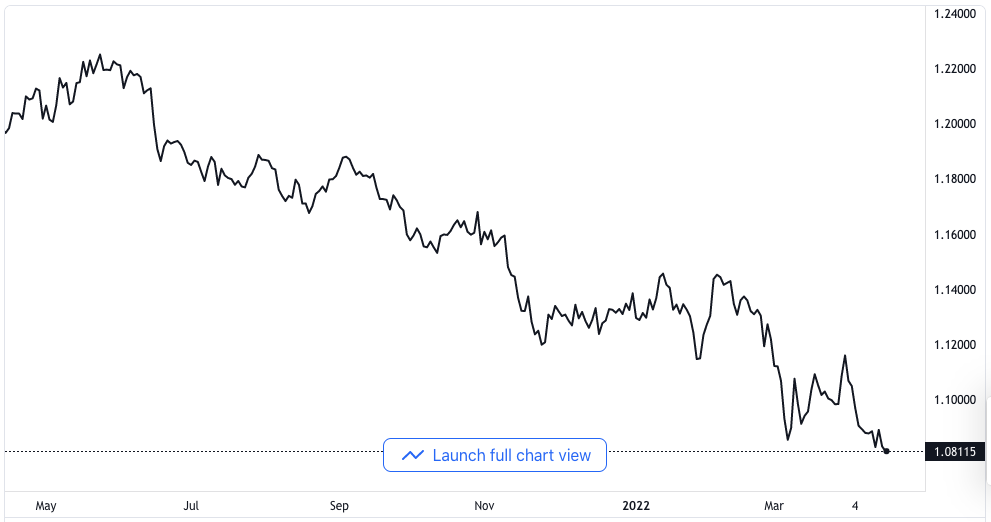

The Euro and US dollar currency pair has seen a very short period of drawback after it printed a new annual low point at 1.0757 as the market was closing on Thursday. There was the start of an intensive sell-off movement for the Euro following the announcement of an unchanged policy in interest rates by the European Central Bank, and it was in tandem with the expectations of the financial market.

EUR/USD price chart. Source TradingView

From a technical perspective, the European Central Bank’s choice to maintain the status quo, as announced by the bank’s President, Christine Lagarde, was rightly on the list of things expected to happen this week. The dovish stance of the President’s speech, therefore, forced market players to drop the Euro from Thursday.

President Christine Lagarde of the European Central Bank unveiled the guiding principles that will be on the interest rates as she stated that an increase in interest rates would only come after the Asset Purchasing Program has ended, which is set to happen in the third quarter of the year.

The bank’s dovish stance on future monetary policy announcements is largely supported by the escalating situation in Europe of the skyrocketing increase in the price of commodities and especially the exploding inflation rate which now stands at 7.5%. All these are joined with the almost insignificant rate of economic growth due to economic fallouts from the ongoing war in Ukraine. It is expected that the tough economic situation at hand now is set to get worse for the European Central Bank as oil and gas prices are advancing towards the next level of increase, and the bills from energy alone will begin to be problematic for households around Europe.

DXY Recovery

Meanwhile, in the United States, the US dollar index has recovered its strength in the midst of a stronger rebound that occurred in the US Treasury bond yields. The dollar index is trying to balance above 100.00, and it seems likely that it will prolong its gains taking into consideration that there is going to be a long weekend ahead and a bit of uncertainty in the global market.

The ten-year bond yield of the US Treasury has recovered from the losing streak of two trading sessions, and it has now reclaimed a high point of three years at 2.83%. The Treasury yield of the US shot up on the back of plans by the Federal Reserve to implement more aggressive monetary policies at rapid rates. A 50 basis point increase in interest rates is in view for the month of May.