Managing to Stay Afloat

The EUR/USD currency pair is still on its back foot close to the intraday low point as it hangs on to its trading range of about two weeks. It is defending the 1.0500 mark with all its power while going into the European session on Thursday.

The leading currency pair stayed away from prolonging the downturn experienced two days prior as bullish traders of the Euro got ready for a comeback after a while. This is even though the recovery was just beginning.

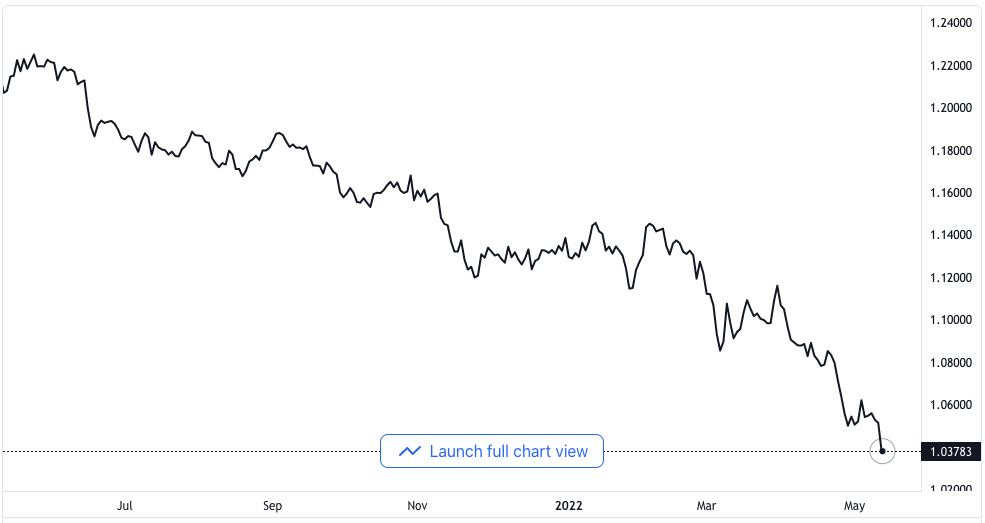

EUR/USD price chart. Source TradingView

It looks like the Euro relies on the series of hawkish statements coming from policymakers of the European Central Bank. Many top officials from the bank, including the President, Christine Lagarde, and the Vice President, Luis de Guindos, all called the concern for inflation. At the same time, they added their voice to the need for an increase in interest rates in July.

The European Central Bank’s President, Lagarde, said that her expectation still focuses on the APP concluding in the early days of quarter three. She said the conclusion of the APP should be followed by an interest rate increase that might come after just a few weeks.

The Bank’s Vice President, de Guindos, also spoke in the same line when he stated that inflation might continue to be in the range of 4% to 5% in the Eurozone by the end of the year. The executive added further that the Asset Purchase Program is very likely to end in July.

The Options Market and the ECB Inflation Outlook

Another set of factors boosting the morale of buyers in the market are developments around the options market. The risk reversal for one month has printed its largest figure on a daily basis in a week while it equally gets ready for the weekly jump that is likely to be the heaviest in two months. The daily and weekly risk reversal stands at 0.263 and 0.413 respectively.

On the other hand, the US Dollar fought against higher inflation figures in spite of the most recent increase close to the twenty-year high. But recently, policymakers have withdrawn their call for the bold move. In the course of the early Asian session on Thursday, James Bullard of the St. Louis Federal Reserve said he would reduce his tone around single inflation reports.

The COVID crisis in China and reduced bond yields have underpinned the mixed session. It has consequently sustained the market in the direction of buying the US Dollar while there are hopes of a 70 basis points interest rate increase.

After the movements in the US inflation figure and statements from ECB executives, traders of the EUR/USD pair envisage that the monthly Producer Price Index of the US for the month of April would come in at 10.7%. This is against the 11.2% figure that was printed in March.