Positive Traction Came Early

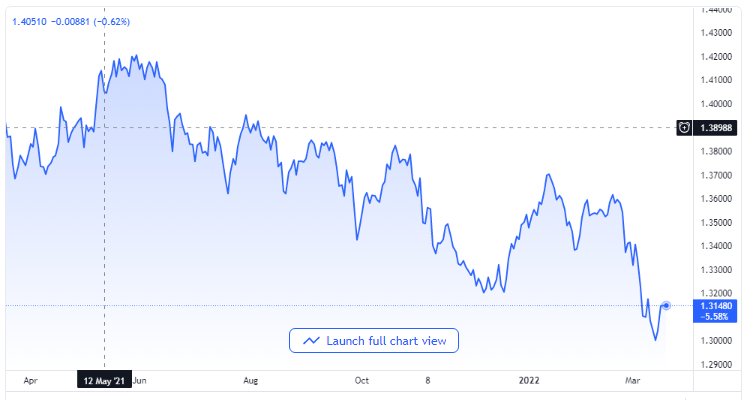

The GBP/USD currency pair gave up its average intraday gains and slid lower to a new daily depth under the mid 1.3100 levels in the course of the early phase of the European session.

The currency pair happened to have gained some positive traction and consolidated in the early phase of trading as the market opened on Friday. However, the upward indicator could not proceed much further when it got close to the 1.3180 to 1.3185 zones in the midst of a relatively good pickup in the United States dollar demand as a safe-haven asset.

GBP/USD price chart. Source TradingView

The inability of the series of peace negotiations being mediated between Russia and Ukraine to yield the much-needed ceasefire deal has kept a tight lid on the latest round of optimistic moves in the global money market. This came in evidently as there was a widespread softer willingness to take on risks which consequently drove some safe-haven funds in the direction of the US dollar while it then became a headwind to the advantage of the GBP/USD currency pair.

The Federal Reserve Policy Influence

Aside from the mentioned, the pair further got underpinned by the Federal Reserve’s hawkish positioning, which indicates that it might proceed to further increase the interest rates during all its next six policy meetings of this year. Notably, the Federal Reserve’s Chair, Jerome Powell, mentioned that the United States central bank is likely to begin reducing its nearly $9 trillion recorded balance sheet in the next meeting of the apex bank coming up in May.

This, as well as the dovish analysis of the Bank of England and its decision announced on Thursday, are expected to keep capping the increase for the GBP/USD currency pair.

As a matter of fact, the Bank of England has increased its rates for the third in quick succession, although some investors are disappointed over the 25 basis points because they had hoped for a more hawkish increase. Nevertheless, the bank has given a softer tone over future rate increases as there might be no need for such. Aside from that, the eight to one vote of the Monetary Policy Committee gives more credence to the bearish disposition.

That being said, the rebound recorded overnight from under 1.3100 zones calls for a level of caution on the side of bearish traders.

The mix-up in basic setup makes it very prudent for traders to either wait till there is a sustainable strength over the 1.3200 benchmarks or till there is an acceptance under the 1.3100 benchmark before they place any aggressive bets.