Troubles in Consolidation

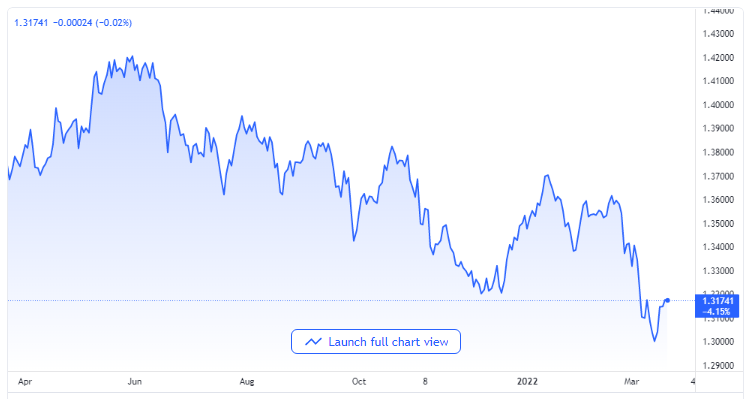

The GBP/USD currency pair has maintained its defensive positioning throughout the early European trading session and it was last observed trading very few points over the daily low points in the vicinity of the 1.3155 zones.

The pair had a moment of struggle in trying to capitalize on the goodish recovery it experienced on Friday from the 1.3100 benchmarks and it edged lower as the week opened up for business as the US dollar is gaining modesty in its strength. In spite of the hopes for a resolution to find a ceasefire deal in the war between Russia and Ukraine, most investors have their concerns intact while the city of Kyiv is being continuously bombarded by the Russian air force. The evidence of this was seen in the caution mood that pervaded the entire financial market sphere which, of course, benefited the US dollar as a safe-haven asset, and put some weight on the GBP/USD currency pair.

GBP/USD price chart. Source TradingView

Moreover, the Federal Reserve’s hawkish policy position indicates that it might be raising interest rates further during all the six remaining meetings it will be having this year. This has acted as a tailwind to the currency pair. In addition to the aforementioned, some influential members of the Federal Open Market Committee stated on Friday that the central bank has a need to take up more hawkish policy positions to fight the escalating inflation rate. This has aided the bond yield that’s on the ten-year American government bonds to be steady just under the highest level achieved since June 2019 and underpinned the US as a safe-haven much more.

Dovish Pressure Sustained on the British Pound

In the United Kingdom, the pound has been pressured by dovish sentiments and the Bank of England’s policy direction in the outgone week. As a matter of fact, the Bank of England increased its interest rates for the third consecutive time although the 25 basis points rate increase was a disappointment to investors who were anticipating an aggressive increase. Importantly, the UK’s apex bank has downplayed its tone about the need for more rate increases in the future.

The basic background, alongside the price action that followed the Bank of England’s policy, makes it seem like the way of the least resistance for the GBP/USD currency pair is downwards. That said, the absence of follow-up sales calls for a measure of caution on the part of bears and their posturing for a significant downside to take advantage of.