Inflation Hits a New High

The GBP/USD currency pair has failed to be in tandem with the UK’s inflation rate which has reached a record high. The inflation rates missed the speculated target. The pair have now taken offers close to 1.2475 following the consumer price index for the month of April that came in lower than was expected in the early hours on Wednesday during the European session.

That said, the consumer price index for the United Kingdom increased to 9.0% year-on-year against the 9.1% that was expected. Meanwhile, the central consumer price index came in exactly as was expected at 6.2% year-on-year against the 5.7% initial report.

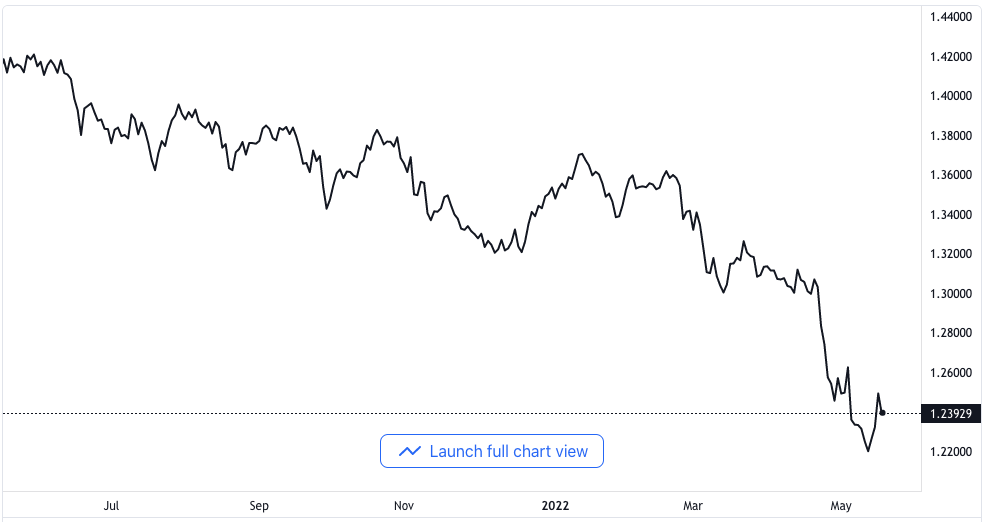

GBP/USD price chart. Source TradingView

While at that, the United Kingdom’s inflation figures underpinned the GBP/USD currency pair and its more recent moves. It challenged the market’s risk appetite. The strong US Dollar and Brexit dynamics are also other factors that posed a challenge to the upward momentum.

Still COVID

A new rise in the COVID cases in China and the holding back of Shanghai from completely putting an end to the lockdown is weighing on the market’s sentiment. Further plans by the United States and the European Union to impose more sanctions on Russia as a result of the war also add more weight to the sentiment.

Statements from the President of Chicago’s Federal Reserve, Charles Evans, that the Federal Reserve should increase interest rates up to a range of 2.25% to 2.5% in an expeditious manner also put pressure on the mood. The Chairman of the Federal Reserve, Jerome Powell, and the hawkish President of St. Louis, James Bullard, further pushed for a 50 basis points rate increase on Tuesday.

Note that the European Union’s willingness to give latitude to the UK in order to have the country not hinder the Northern Ireland Protocol yielded good fruits. Nevertheless, the British government is determined to amend some of the Northern Ireland Protocol and the EU is looking at effecting tougher trade agreements if the UK goes ahead. That will inevitably put a higher risk on Brexit.

The jobs report from the UK on Tuesday increased the odds that the Bank of England would implement more rapid and higher interest rates. The report came after statements by the Governor of the Bank of England, Andrew Bailey, where he gave indications of fears of more inflation.

Against that background, the ten-year US Treasury bond yield oscillated close to 2.98% meanwhile, S&P 500 futures fell by 0.20% on the intraday despite Wall Street declaring huge profits.

After the first reaction to the inflation report of the UK has been seen, traders of the GBP/USD pair are to pay close attention to news about Brexit and other risk factors. They would also need t watch out for the Housing report from the US as well as the building permit for the month of April to get new impetus.