New Sales Attractions

The USD/JPY currency pair was trading with an average but positive bias in the course of the first part of the European trading session, and it was observed revolving around the vicinity of 125.65 to 125.70 zones as it went up more than 0.25% for Tuesday’s record.

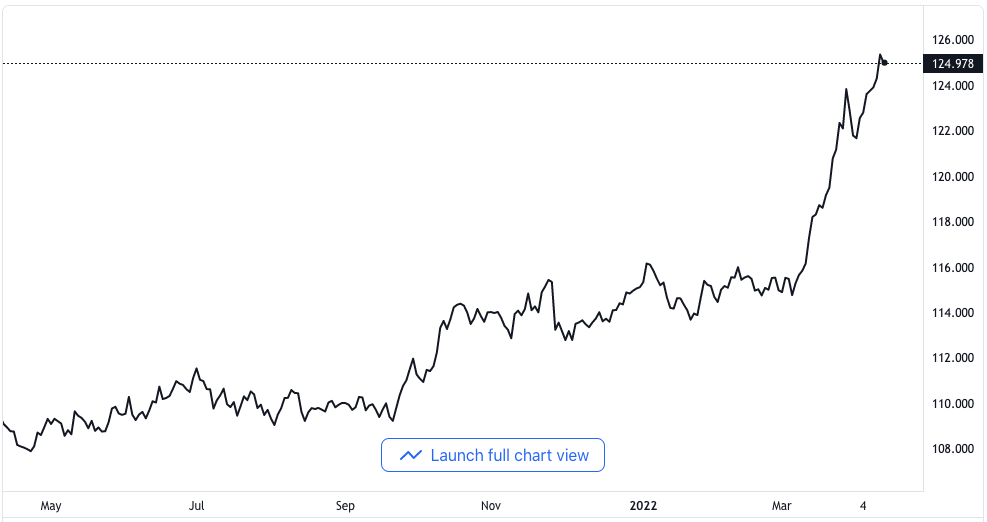

The pair was able to draw a new round of purchases in the close area of the 125.00 psychological benchmarks on Tuesday, and it later climbed back and closer again to the highest point it had seen since June 2015, which it reached on Monday. The increasing difference between the bond yield of the US government and the Japanese government yields has continued to weigh more heavily on the yen, and it is acting favorably as a tailwind that aids the market value of the USD/JPY trading pair as the US dollar keeps strengthening.

USD/JPY price chart. Source TradingView

The Bank of Japan, however, continues with its rhetoric that it maintains its readiness to utilize every powerful tool at its disposal to ward off the rise of interest rates from increasing so much over the long term. As a matter of fact, just last month, the Bank of Japan said it would purchase an unlimited number of the Japanese government’s ten-year bonds in order for it to defend the 25 basis points yield capitalization.

The policy decision was effective, to a degree, in negating a widespread weak tone for the yen, and it served to be of benefit to the Japanese yen as a safe-haven asset.

US Consumer Inflation Rates Anticipated

In the United States of America, on the other hand, the broad-based expectation that the Federal Reserve is going to execute a more stringent monetary policy to tighten things up helped to boost the US Treasury bond yield and got it to a new height has not been in many years.

In addition to that, the increasing worries about the soaring price of commodities are set to add more pressure to the currently bloated consumer inflation. This gives some support to the US bond yields, nonetheless. Consequently, the US dollar is lifted to the highest level it has been since last May.

That said, bullish traders were held back from taking aggressive bets by overbuying conditions relating to near-term charts. Investors are equally reluctant to buy now, but they would rather wait to see reports from the consumer inflation data coming from the United States.