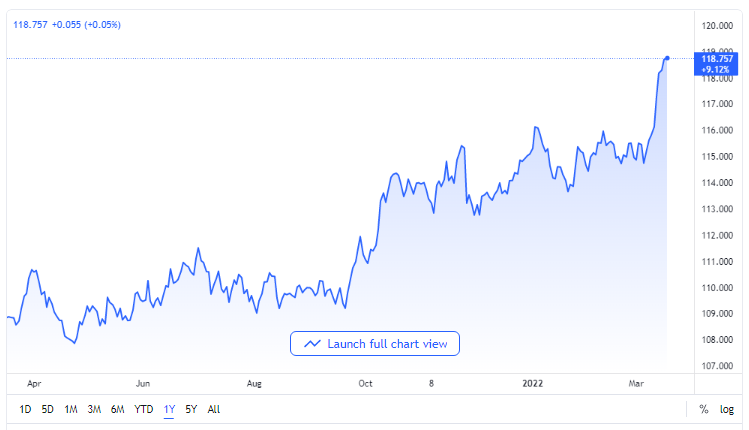

Asian Pair Hits Record Height Again

The USD/JPY currency pair has once again made records, now of a six-year high, coming in at 119.12 following the monetary policy push of the Federal Reserve of the United States by finally increasing the country’s interest rates for the first time since 2018. The latest increase comes at 25 basis points as priced in by a segment of the market. The decision was finalized early as the Federal Reserve had no other options but to go for an interest rate increase to curb the skyrocketing inflation.

Taking into account the continued war between Russia and Ukraine and a palpable fear of eventual stagnant inflation, seven of the eight voting members of the Federal Reserve’s monetary policy committee voted to have a less rapid interest rate increase.

USD/JPY price chart. Source TradingView

Consequently, the Federal Reserve has proceeded to announce seven circles of interest rate increases in the course of this year. It closely looks like the US dollar is currently underpinned in comparison with the Japanese yen as news filtered in about the seven circles of interest rate increases this year while a 25 basis points increase was already announced by the Federal Reserve Chair, Jerome Powell, in his testimony before the US Congress early in March.

Market Expectations Almost Well-Managed

Although the markets were already expecting considerably aggressive hawkish dispositions in implementing monetary policies by the Federal Reserve this year, what was neither expected nor taken into consideration is having up to seven circles of interest rate increases in the course of one year.

In the meantime, the US dollar index that keeps track of the dollar against a number of other leading fiat money in the market was, at the time of putting this report together, moving around 98.50 while it waited for some new impetus from the Eastern European crisis. The ten-year United States Treasury bonds yield has gone up close to 2.19% following the monetary policy announcement of the Federal Reserve.

Investors will now keenly focus on the ongoing peace negotiations being mediated between Russia and Ukraine and hope something tangible comes out of it really soon. Both parties are seeking ways to have a ceasefire at all costs, but all market players cautiously wait for absolute clarity before making significant moves.

Aside from the crisis in Eastern Europe and the economic dynamics in the United States, the Bank of Japan is also scheduled to make announcements on its interest rates on Friday. It is speculated that the Bank of Japan might choose to maintain its initial position by leaving interest rates at 0.1% where it currently stands.