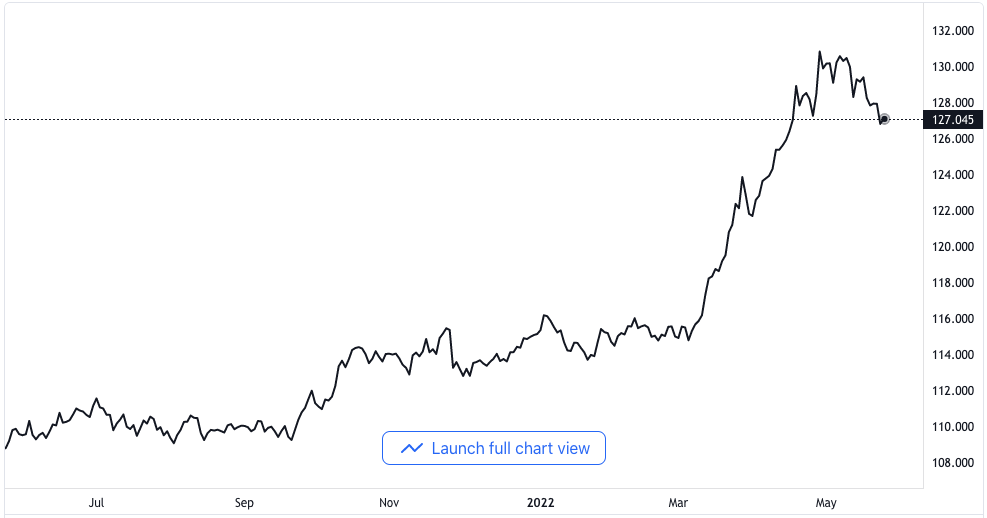

Dip from a Multi-Year High

The USD/JPY currency pair is currently struggling against selling pressures. It is going on close to the round-figure resistance level of 127.00. This was the situation that started in the early part of the European session.

An open rejection reversal move by bulls in Tokyo took the pair to an intraday high. The intraday height was 127.21. On a general note, the USD/JPY pair is dropping after it hit a multi-year high.

USD/JPY price chart. Source TradingView

The pair’s multi-year high reached on the 9th of May stood at 131.35. The Japanese Yen is being underpinned against the US Dollar. The underpin is on the back of the increased numbers from Jibun bank PMI.

Encouraging PMI Figures Amidst Falls

The new Purchasing Managers’ Index came in on Tuesday. The manufacturing Purchasing Managers’ Index came in at 53.2 versus the expected 52. The services Purchasing Managers’ Index, on the other hand, came in at 51.7.

The Services PMI was higher compared to what was expected of it at 50.6. The Bank of Japan continues advocating for a frugal monetary policy. This is aimed at pushing the aggressive demands much higher.

Investors have been advised to get ready for a more quantitative relaxing of the policy. This is necessary since the economy has to get back to levels before the pandemic.

In the United States, the Dollar Index is trying to outperform the significant 102.00 resistance. Investors are still expecting a very hawkish tone from the FOMC minutes to be published. The FOMC minutes might direct the position of the Federal Reserve policymakers.

Equally, the market will be brought up to date with the US’s present economic strength. Without a doubt, the Feds would be compelled to implement a 50 basis points increase. This is because of the increasing inflation as well as the tight labor market.

Nevertheless, voters in favor of 75 basis points are the major ones to watch. They are a valid component in the process.

Japan’s government has called on the BOJ to work on achieving the 2% inflation target. The government says it has to be in a stable and sustainable fashion. Reuters reported after getting access to a draft of the long-term policy journey.

Sources at the bank said the government will keep carrying out flexible policies. The policies will have frameworks that combine solid monetary policies as well as fiscal policies. The growth strategy also aims at aiding private sector investments.