Drop from Many Years’ High, Yet Sustained

The USD/JPY currency pair maintained its stability on the day close to the 130.00 area. The pair sustained the drop from a high point of many years, which swept by on Monday. The pair equally managed to stay over the low point of the intraday movement in the early trading session in Europe on Tuesday.

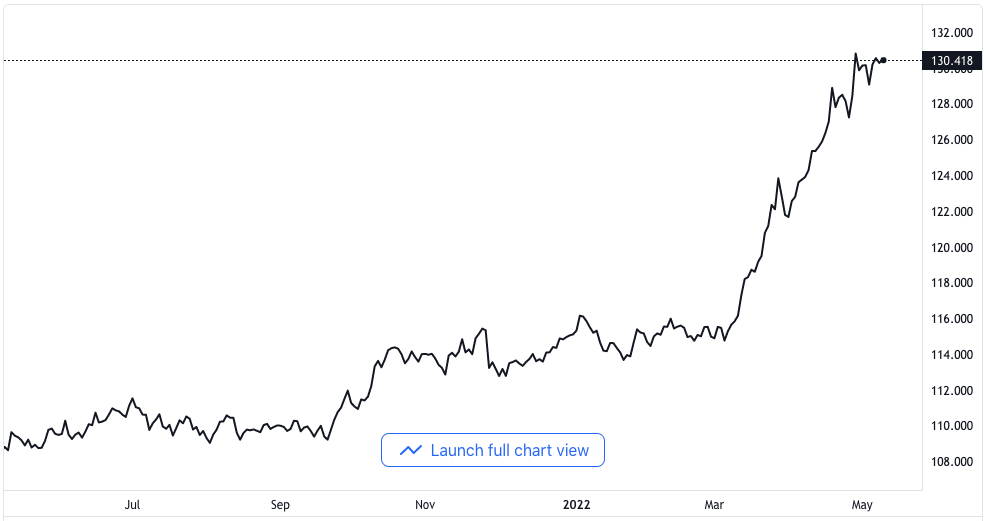

USD/JPY price chart. Source TradingView

Traders had time to catch their breath from the huge volatility that took place on Monday. Another factor that sealed the AUD/JPY pair is the US Treasury yield’s pullback and averagely good sentiment in the market. This is not to sweep comments from the Bank of Japan’s Executive Director under the carpet.

Shinichi Uchida, the Bank’s Executive Director, said that the Bank of Japan must keep up with its support of the economy with easy monetary policy. A complimentary statement also came from the Finance Minister of Japan, Shunichi Suzuki. He applauded the monetary policy divergence between Japan and the United States.

That said, the ten-year US Treasury bond yield prolonged the pullback it had at the beginning of the week. The pullback went from a twenty-year high point and down by 5 basis points close to 3.0% at the minimum. This happened as the market is anxious over the next move from the Federal Reserve with Raphael Bostic of the Atlanta Federal Reserve pushing for 50 basis points interest rate increases.

Some Fed Officials Campaign for 75 Basis Points

Whereas, the President of Richmond Federal Reserve, Thomas Barkin, holds on to an increase by 75 basis points. The expectation from the US inflation report, with regard to the ten-year breakeven rate from the St. Louis Federal Reserve report, fell to its lowest in ten months. The data has hit a point where it had to retest the levels it was in March on Monday.

Statements released by the Vice Premier of China, Liu He, have hammered on the unique zero policy on COVID in the country. The speech gave the needed respite to stock futures in the United States, which have been hovering over the annual low for a while.

One should, however, not be oblivious of the fact that inflation fears that weigh on economic perspectives are still keeping the USD/JPY pair on alert. The COVID situation in China is also having the same effect on the currency pair.

Another factor that is likely to keep underpinning the US Dollar’s safe-haven role is the ongoing war in Ukraine. Despite all of these, the expected consumer price index for the US coming up on Wednesday is expected to come in at 6.0% year-on-year against the previous 6.5%. this becomes very crucial as there is a possibility of a 75 basis points rate increase.