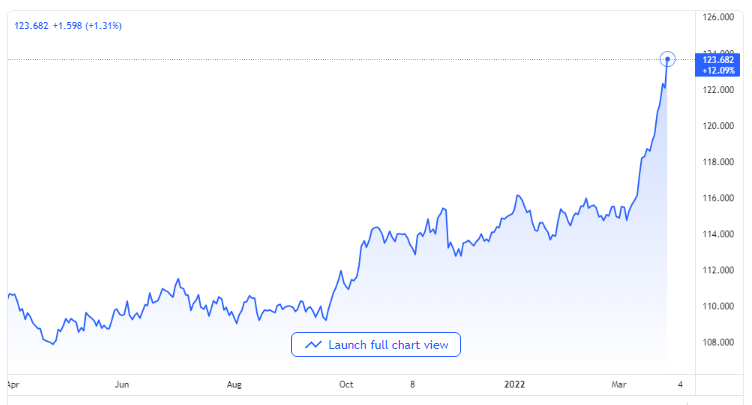

Extended Increase for the Pair

The USD/JPY kept to its increasing trajectory all through its course in the first part of the early European session as it climbed to the major 124.00 psychological points for the first time after it was last at that level in August 2015.

After the average slide seen on Friday, the Asian-focused pair drew a number of aggressive bids on Monday as the week opened for business, and the Bank of Japan upped its game to tame the rapidly rising yields. For impact, the Bank of Japan proposed two offers in one day to purchase an unlimited number of ten-year Japanese bond yields to give further protection to the 0.25% allowance covered in its yield control policy.

USD/JPY price chart. Source TradingView

On the other hand, the yields present on the marked ten-year American government bond yields rose to an almost three-year high, more than the 2.5% benchmark in the middle of expectations that there will be a more aggressive monetary policy reaction by the US Federal Reserve. This culminated in a wider spread of the US and Japanese bond yields, which, coming together with a widespread positive feel in the stock markets, moved funds away from the Japanese yen as a safe-haven asset.

50 Basis Points of Increase Eagerly Expected

Taking more facts into consideration, the financial market has begun pricing in up to 50 basis points interest rate increase by the US Federal Reserve in its next monetary policy meeting scheduled to hold in May. There are equally general and valid concerns that the escalating price of regular commodities would apply more upward pressure to the already blown-up inflation rates.

While the foregoing happens, it maintains solid support for a measure of follow-up purchase of the US dollar as it gives a more direct boost to the USD/JPY currency pair. It also went away with a number of trading stops that were positioned close to the 124.00 benchmarks.

Therefore, the most recent track of what seems to be a sudden increase in the course of the early session of trading might be conveniently linked to a measure of technical or professionally advised purchases. This calls for a level of caution on the side of investors before they stake new bullish wagers while there are overbuying situations pervading the market.

As there are no significant economic reports expected, the US bonds yield, US dollar price movements, and the general risk sentiment are expected to give more impetus to the pair.