Intraday Drop Off

The USD/JPY currency pair shed off some of its intraday profits, and it was observed to trade close to 128.00 benchmarks in the course of the early European session on Thursday as it went up about 0.15% on the daily chart.

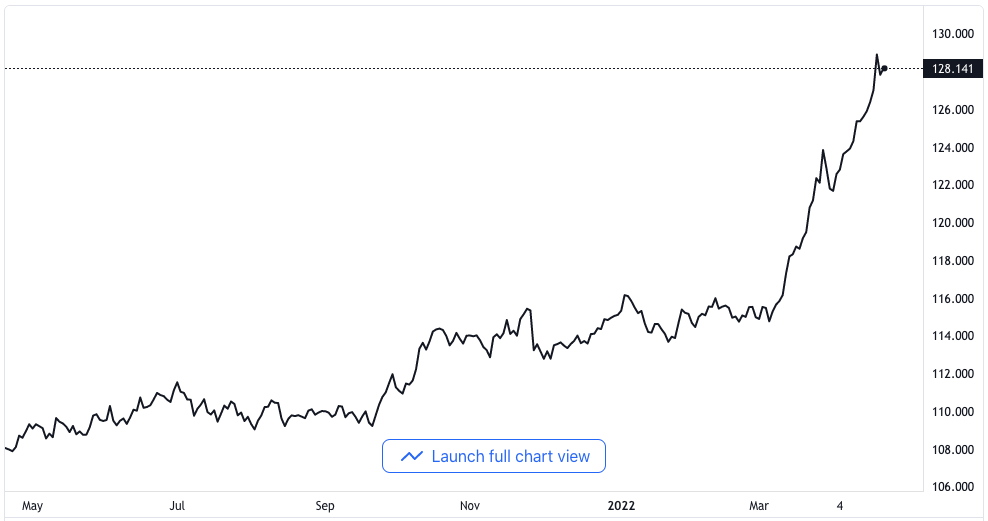

USD/JPY price chart. Source TradingView

After the sharp drawback that occurred on the previous day from a peak of 20 years, the USD/JPY currency pair was able to draw new sets of purchases to itself as the market opened up on Thursday, and it gained support from several factors combined. A broad-based tone of positivity around the global stock market put funds away from the safe-haven Japanese Yen. The Yen was still weighed further down by the intervention move of the Bank of Japan in buying an endless amount of government bonds to halt the increasing ten-year bond yield. The decision of the Bank of Japan to buy the government’s bond was on its second consecutive day, and it was aimed at defending the yield capitalization at 0.25%.

Suzuki and Yellen to Meet

Bulls took a further cue from the positive recovery in the US Treasury yields, which had considerable support from the hawkish expectation from the Federal Reserve. It looks like the market is convinced that the Federal Reserve would further tighten its monetary policy at a more rapid rate in order to fight the skyrocketing inflation, and as a result, the market has priced in many 50 basis points interest rate increases this year.

In turn, this helped to renew demands for the US dollar, and it was taken as one of the factors that became a tailwind for the currency pair of the US dollar and the Japanese Yen. Having that in mind, the anticipations that Bank of Japan’s officials are going to respond to the latest fall of the Yen have capped the pair’s an upside.

The Finance Minister of Japan, Shunichi Suzuki, came out with a very explicit warning when he stated on Tuesday that the damage done to the Japanese economy by weakening the Yen is far more than any benefits that might have been derived from it. There is a scheduled meeting between Suzuki and the US Treasury Secretary, Janet Yellen, this week. The planned meeting is holding back traders from staking aggressive bets till it is concluded. It has also put a lid on further gains for the USD/JPY currency pair, and it resulted in a drawback on the intraday of more than 50 points from the daily high point around the 128.60 area.