Lackluster trading in the Face of Multiple Downturns

The EUR/USD pair is showing a lukewarm performance while the Asian session is on. The currency pair was found to be oscillating just a little under the range of 1.0391 to 1.0398 in spite of the bit of healthy slide seen in the US Dollar Index. Bullish traders of the Euro lost heavily on Thursday following the publication of the producers’ price index by the Bureau of Labor and Statistics in the United States.

The producers’ price index of the United States came in at 11% against 10.7% which was expected on an annual basis. The official indicators that show the inflation level of commodities has strengthened the US Dollar against the Euro.

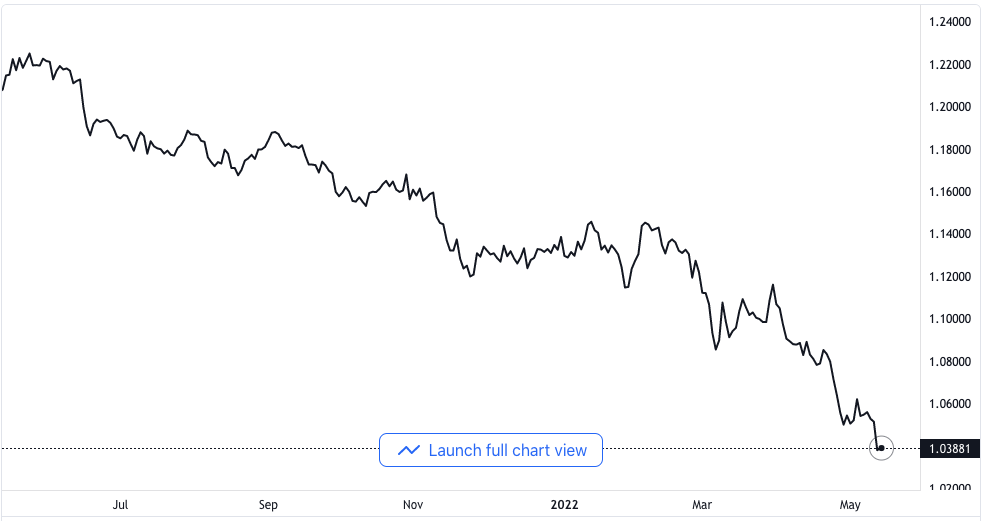

EUR/USD price chart. Source TradingView

The Chairman of the Federal Reserve, Jerome Powell, granted an interview with the Marketplace National Radio. The interview has unintentionally put up the possibility of two additional high-interest rate increases following each other in the coming policy meetings. Initially, some quarters were expecting just one more interest rate increase, but more than the 50 basis points that were announced in the first week of May.

Having to expect a long-drawn series of aggressive interest rate increases might spike uncertainties in the foreign exchange sector.

An Embargo on Russia Oil Might Imply Much More for the EU Than Bargained For

In the meantime, bulls of the Euro currency are currently considering the embargo placed on oil imports from Russia. In spite of Germany withdrawing its opposition to banning Russian oil at such short notice, the European Union still faces a serious bottleneck in the area of the global supply chain.

Other obstructing factors include reduced production of oil and fears of unemployment that would result from announcing an embargo on Russian oil.

During the session Friday, the consumer sentiment index from Michigan has a lot of significance. It is expected that the catalyst would come in at 64 versus the initial print of 65.2. Any good performance from the consumer sentiment index from Michigan is going to give more impetus to bulls of the US Dollar.

In related matters, the industrial production in the Eurozone dropped short of expectations in the month of March. Eurostat’s official data revealed this through its publication on Friday, as it suggested there was a downturn in the manufacturing sector.

The bloc’s industrial output came in at -1.8% month-on-month against a drop of 2.0% that was speculated and 0.5% that was last seen. On an annual basis, the drop in industrial output was at 0.8% in the month of March against a -1.0% drop that was speculated and that of February that came in at 1.7%.