All Focus on Feds

The GBP/USD currency pair experienced a modest fall on Wednesday. The modest fall comes while the market awaits statements from the Federal Open Market Committee meeting. The pair began to fall after it reached the daily height of 1.2537.

The GBP/USD pair’s fall is testing the 1.2465/70 area of support where the low of the past three days settled. The British Pound, on its part, stayed above and recovered to 1.2500

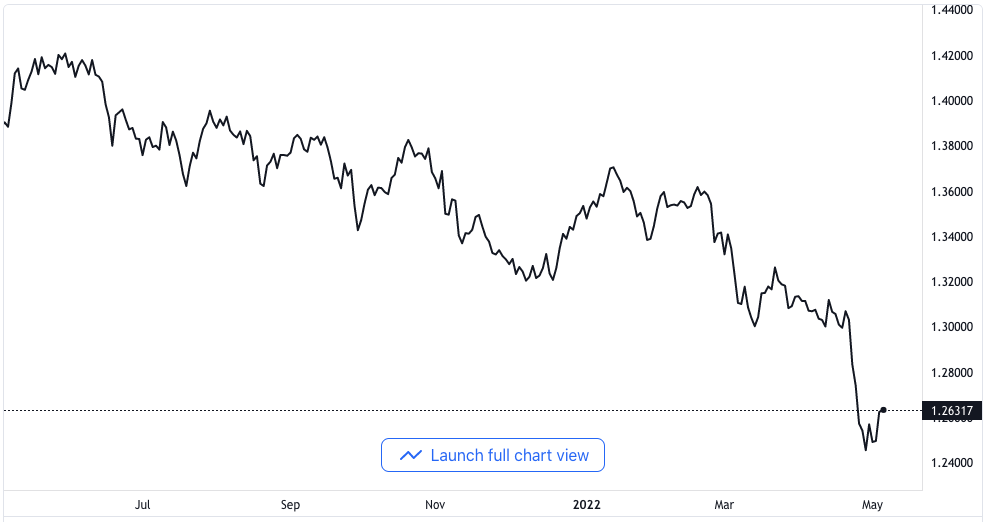

GBP/USD price chart. Source TradingView

All market players are awaiting the result of the Federal Open Market Committee meeting. The US Dollar Index also experienced a fall as it traded at 103.25. Meanwhile, the US bond yields got pulled back into neutrality.

Data’s Little Value as the Market Looks to the Fed

Almost all economic data coming from the United States came in at weak levels. However, the weak state of the data had no effect on the US Dollar. The US Automatic Data Processing Employment record revealed an increase in private sector jobs.

The number of jobs recorded to have been generated came in at 247,000, less than 395,000 speculated. The ISM Services Purchasing managers’ Index for the month of April fell without notice from 658.3 to 57.1. At the same time, the S&P Service MIS got a revision from 54.7 to 55.6.

All these figures that came in were largely ignored as attention was on the Federal Reserve’s event. It is expected that the Federal Reserve will announce a new interest rate increase of 50 basis points as inflation rises. The projects will be updated further in the coming days.

The press conference of the Federal Reserve Chairman after the announcement will be closely monitored. It is expected that Powell’s speech will give a clearer direction on the path of the policy for near-term investors. It is speculated that it would also keep the market’s volatility high.

The Bank of England is expected to announce its monetary decision on Thursday. It is expected that there would be another 25 basis points increment to 1.00%. This increment would be just another in the series of rapid rate increases from the Bank of England in recent times.

Financial analysts at ING stated that the GBP/USD currency pair snapped under 1.2500 again. It was the third breaking under that level in the course of three sessions on Wednesday morning. Such moves that happened on Monday and Tuesday were rapidly salvaged.

It now seems like a matter of time before the pair makes a significant break to lower levels. If it does not happen after the announcement from the Federal Open Market Committee, it could come after the Bank of England’s announcement.

Financial analysts at ING expect the policy of the Bank of England to defy the expectation of hawks and put additional pressure on the Pounds. The British economy has been affected by many factors that increased the household cost of living. Economic fallouts from the war in Ukraine and escalating gas prices top the list.