Safe Holdings

-

Assessment

Summary

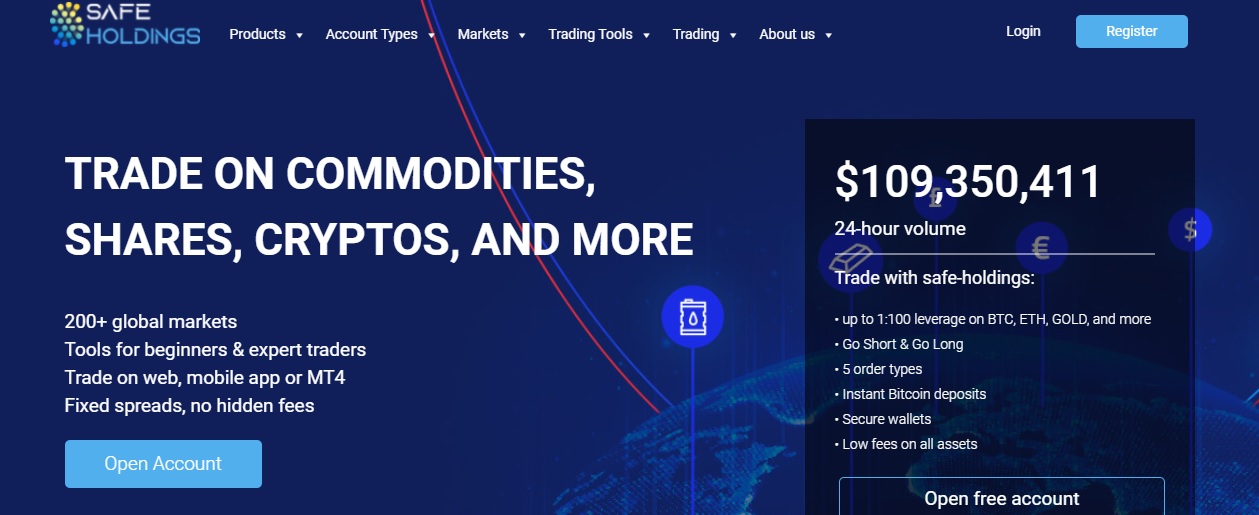

The Forex College has made an assessment of Safe Holdings for you today and we have concluded in our Safe Holdings review that it is indeed a recommended broker. You can understand why in this review. You can sign up with Safe Holdings trading platform in the link below or continue reading to learn all you need to know.

Safe Holdings Review

Have you been looking for a broker online? If you have been considering options, there is a strong chance that you have come across Safe Holdings. Once you have done that, you would obviously want to know more about the company and see if they are capable of offering you the services you need. This is where Safe Holdings review comes into play, as it can provide you the essential details. If you are wondering why you need to go through this process, then you need to understand that your success in the trading world is heavily dependent on the broker you select.

Have you been looking for a broker online? If you have been considering options, there is a strong chance that you have come across Safe Holdings. Once you have done that, you would obviously want to know more about the company and see if they are capable of offering you the services you need. This is where Safe Holdings review comes into play, as it can provide you the essential details. If you are wondering why you need to go through this process, then you need to understand that your success in the trading world is heavily dependent on the broker you select.

Even before trading shifted online, brokers were playing a very important role in the financial markets and while there were a lot of changes, their job has remained consistent. In the world of online trading, they act as the key that opens the door of the financial markets, helps traders in connecting to the market of their choice and give them the platform and tools they need for trading. You cannot eliminate them from the process and they obviously charge you for their services as well. This is one reason that you need to make the right choice because your trading cost will depend on the company you choose.

Online trading is immensely popular because it provides a lot of benefits to people and has simplified the traditional trading process. Consequently, the number of brokers operating in the market increased exponentially and today, you will have a horde of options to choose from. Having options is undoubtedly a good thing because the increased competition means that companies will try to offer better quality of services and at low cost, but it can also come with a downside. When there are multiple options, it can often be difficult to pick one.

It should be noted that the online world is rampant with frauds and scams and this also applies to brokerages. Hence, you cannot just trust the claims made by a company and they need to be verified before you move forward and sign up for their services. This verification can be done in the form of a review and you can learn everything that’s necessary and can help in your decision making. As stated earlier, one of the names that you will find is Safe Holdings, which is a Bitcoin-based platform. This means that it is a relatively new addition to the market, as it was founded in 2018.

Some might consider their lack of experience a disadvantage, but apparently, the company has made up for it in some way because they have become quite popular and are now offering their services in more than 150 countries around the world. How have they managed to do so? You need to do a step-by-step evaluation of their services in order to decide and this will help you in choosing right, thereby determining your experience and the profits you make.

Here is a step-by-step evaluation of Safe Holdings that can be helpful:

| Broker | Safe Holdings |

| Website | https://www.safe-holdings.com/ |

| Trading Accounts | Five Account Options; Silver, Gold, Platinum, Diamond and VIP Accounts |

| Minimum Deposit | €10,000 |

| Assets Coverage | Forex, Cryptocurrencies, Stocks, Indices and Commodities |

| Trading Tools | Trading Indicators, Signals, Live Charts, Technical Analysis Tools, Price Alerts and Risk Management Tools |

| Education and Training | Yes; , e-books, online video courses, webinars, tutorials, fundamental market data and market analysis |

| Customer Support | 24/7 through email. Different email addresses for different queries |

| Security Policy | KYC (Know Your Customer) and AML (Anti-Money Laundering) |

| Parent Company | Safe-Holdings |

Step 1: Consider the registration process

When you have to start the evaluation process for a brokerage, it is a good idea to begin with their registration process. What do they need from you to register for their services? Some scams in the market may elicit a lot of personal information during this process because their goal is to take advantage of you, or there are also some that may charge you for registration with the same goal. This is something you need to steer clear of and can only happen when you consider the registration process beforehand and then move forward.

With Safe Holdings, you will be pleased to discover that they have an almost anonymous registration process where they don’t really require you to share anything more than the most basic information. This is certainly reassuring because it means that they are not after stealing your identity or selling your information to anyone; in case you have any doubts, you can check their Privacy Policy in order to ascertain exactly what they will do with the information they do take from you. Furthermore, they have kept their registration process very simple and quick as well, so you will not have to wait for long in order to start trading.

To begin the process, you need to visit the Safe Holdings website and just click on the Register button option. This opens up a form that you have to complete and it will be done in a few minutes. Why? This is because you have to provide basic details like your first name, last name, phone number and your country of residence. The next step is to mention your email address and password. Lastly, you have to agree to the Terms & Conditions they have mentioned on their website and confirm you are at least 18.

As soon as you complete these steps, the registration process is over and you will became a client of Safe Holdings. There is no waiting process involved, which is definitely a relief for people, because it means that they can immediately start trading and not have to watch opportunities go to waste. Also, it is also reassuring that you don’t have to share a lot of information to get started, which means you will not be overly exposed.

Step 2: Go over the account choices

After you have finished the registration process, it is time for you to open an account on Safe Holdings and this means looking at what options they provide. It is considered a norm amongst brokers to provide several account options to their clients and it is not different in this case. However, the number of accounts and their features can vary from platform to platform and this is something that may affect your decision. After all, not all companies are very facilitating and some may have very limited options that many traders are not comfortable with.

The good thing about Safe Holdings is that they are providing their services to traders, regardless of their background. Whether you are a newcomer in the trading space, or someone with years of experience under your belt, you will find this platform to be a suitable choice. This is because they have come up with account options for all trading styles, capital requirements and risk appetites. A total of five account choices have been developed by the company and you can go over each one in order to pick the one that works best for you.

What are the options? Read on to find out:

- Silver Account

Having a minimum deposit of €10,001 and offering raw spreads to its users, the Silver account is the first option you will find on Safe Holdings. There is no markup involved and the spreads are very tight, while the commission remains highly competitive. The account is suitable for high-volume trading and scalping strategies and the maximum deposit that can be made in it is €20,000. It comes with 24/6 customer service, 1:20 leverage, 20% welcome bonus, trading signals and 7 business days are needed for approval of withdrawal request.

- Gold Account

The second account option that you will come across is known as Gold and this one comes with a personal account manager. A minimum deposit of €20,001 is needed for opening this account and it charges fixed spreads from the users. This makes it a good option for use with Expert Advisors (EAs) because you will know exactly what you will be charged. The maximum deposit that can be made via this account is €100,000. It offers quarterly dividends, account executive and withdrawal request approval takes 5 business days. Traders also get a 40% welcome bonus, leverage of 1:40, a complete money management plan, monthly cashback, daily market reviews, one weekly managed session, trading alerts and one-on-one educational course.

- Platinum Account

The next account choice that has been added by Safe Holdings for its clients is referred to as Platinum and this one needs a minimum deposit of €100,001. Traders can now get their withdrawal request approved within 3 business days, get 60% bonus and a leverage of 1:60. Access to premium trading room is also provided and 2 to 3 weekly managed sessions are available. The maximum deposit that you can make in this account is fixed at €200,000.

- Diamond Account

Requiring a minimum deposit of €200,001, the Diamond account is the fourth choice that you will find on the platform and it comes with withdrawal approvals within 2 business days. There is leverage of 1:100 available and an 80% welcome bonus is provided. The weekly managed sessions are also increased to 4 and traders can enroll into a VIP mentorship program. The maximum amount that you can invest in this account is €499,999.

- VIP Account

The final account choice that has been added to the Safe Holdings platform is referred to as VIP and it can be opened with a minimum deposit of €500,000 and no maximum cap is set. As far as features are concerned, your withdrawal requests will be approved the same day and a 1:150 leverage is also provided. Traders can have daily managed sessions rather than weekly ones and they also get a welcome bonus of 120%.

Step 3: Look at the asset index

After you have checked out the account choices you will be given if you opt for Safe Holdings and are satisfied with the options, you can take a look at their asset index. Are they providing the assets you want to trade? If they don’t have the instruments that hold your interest, what would be the point of signing up with them? You will find that they have more than 300 instruments available on their platform and these belong to some of the top financial markets in the world. This is definitely a benefit because it allows you to diversify your portfolio and keep your risks at a minimum.

But, which instruments can you trade? You are given the opportunity to invest in the forex market, which is known as the world’s biggest financial market due to its impressive trading volume. There are a multitude of currency pairs to be traded here. Next comes the stock market, which is known for its profitable opportunities and Safe Holdings enables you to trade shares of some of the most renowned companies in the world. If you are after lucrative trading opportunities, the indices market is a strong option to explore.

They have put together some of the leading indices, which allows their clients to maximize their profits. However, if you are someone with a low-risk appetite, Safe Holdings has added the commodities market as an option for you. There are a range of commodities that can be traded, from precious metals like gold and silver to agricultural products like wheat, coffee, sugar and corn. In fact, they also provide energies like natural gas and crude oil for investment. Lastly, you will also be able to access digital currencies via their platform, which are in high demand these days.

As Safe Holdings is a Bitcoin-based platform, it certainly offers traders the opportunity of investing in cryptocurrencies like Bitcoin, Litecoin, Ethereum and Ripple. As a matter of fact, you can even make deposits and withdrawals in the form of Bitcoin.

Other than following these steps, you can also explore the trading platform and customer support offered by the Safe Holdings and after you have done so, you can open an account to start trading the instruments you want.