Escalating Prices of Basic Necessities

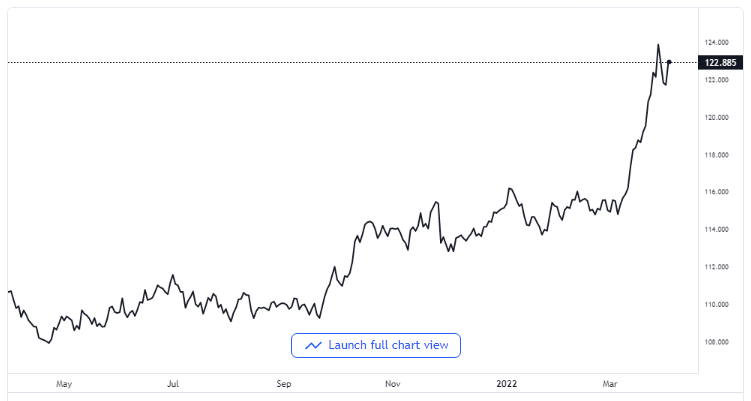

The USD/JPY currency pair is growing enormously higher following a correction close to 121.30 after the Bank of Japan expressed fears over the rapidly increasing price of commodities. The increased prices of food items, base metals, as well as energy as the war between Russia and Ukraine continues has had a devastating effect on the yen.

Since Japan is a large-scale importer of a lot of commodities, it faces an acute threat in its general fiscal deficit.

USD/JPY price chart. Source TradingView

The high effects of the rising prices of commodities were shown on the Japanese yen in previous trading sessions. The currency gained nearly 8% in the month of March. The head of the intervention in currency at Japan’s Ministry of finance, Mitsuhiro Furusawa, expressed his fears about the vulnerability of the Japanese yen as he cited the negative effects of the yen’s continuous drop, saying it is a reflection of competitiveness in Japan.

Likewise, the increased number of bids that accompanied the yen in March has now faded drastically following the conclusion of the Bank of Japan’s program of buying government bonds. The bank concluded its aggressive purchase of the government bonds on Thursday. It embarked on this in the first place so it could cap the bond yields at just 25 basis points.

In the United States of America, on the other hand, the dollar index was able to finally climb close to 98.50 as the odds increase that the Federal Reserve is going to increase interest rates by up to 50 basis points in its policy meeting coming up in May. The Chicago Mercantile Exchange Group monitoring Federal Reserve activities is revealing a 71% possibility of an interest rate increase of half a point.

Non-farm Payroll

The Non-farm payroll records have indicated that the American economy had an additional 431,000 jobs created in the month of March versus the 490,000 that was speculated, although the failure to achieve higher was consoled by the upward move that came on the reading of the previous month at 750,000.

More details from the report show that the US rate of unemployment fell to a slightly impressive 3.6% from where it was in February at 3.8%. The earnings on hourly averages also went up by 0.4% away from 0.1% where it was in February. The report further strengthened market speculations that the Federal Reserve would increase interest rate by up to 100 basis points in its next two meetings.