GBP Hit and the Pair’s New Supply

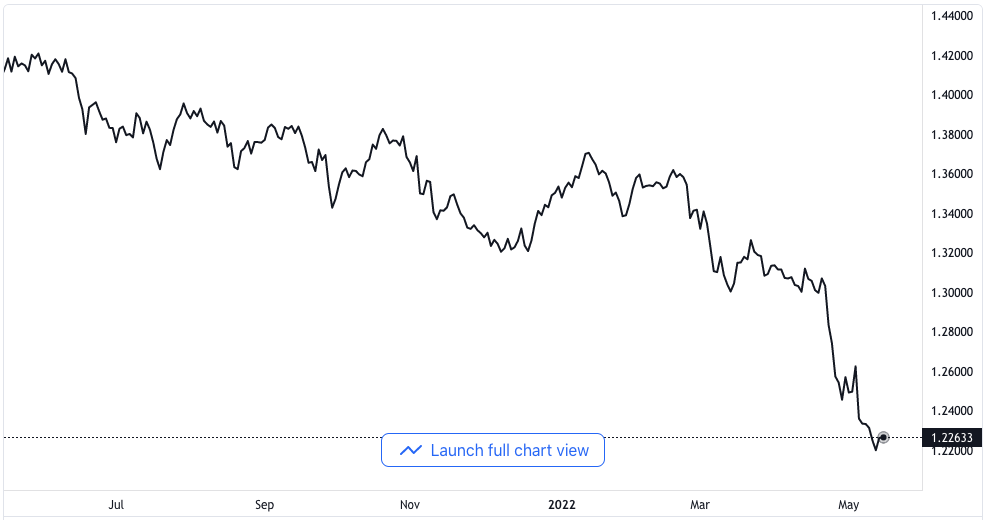

The GBP/USD currency pair, again, still maintained a defensive position throughout the early European trading session. It was last observed to be trading close to the bottom of its daily range, in the vicinity of the 1.2225 to 1.2220 area.

The pair encountered a new supply in the area of the 1.2300 benchmarks early on Monday and delayed its average rebound from a low point of two years. The low point was around the region of 1.2155 which it reached last Friday. The expected macro report from the United Kingdom validates the poor outlook of the economy of the country and indicates that the interest rate cycle of the Bank of England might be close to a halt.

GBP/USD price chart. Source TradingView

Aside from the foregone, news that the government of the United Kingdom is expected to show a plan which it is going to use to change the protocol of Northern Ireland on Tuesday became a headwind for the Pound. The Northern Ireland protocol issue has rocked the stage for a couple of months now.

Across the Atlantic, on the other hand, the US Dollar maintained a firm stand and stood high close to a high point of twenty years. It also kept attracting needed support as the market still expects that the Federal Reserve would further tighten its monetary policy at a more rapid rate to fight high inflation.

The market has been pricing in the minimum of a 50 basis points interest rate increase for the next two monetary policy meetings of the Federal Reserve.

All these, in conjunction with the risk-off atmosphere that has enveloped the market, have underpinned the US Dollar as a safe-haven commodity. Investors are now more concerned about slow economic growth globally while major central banks are implementing aggressive monetary policies, the Ukraine war continues and the COVID policy in China is still on.

The improved strength of the US Dollar is also a factor putting more downward pressure on the GBP/USD currency pair. The basic background looks more firmly tilted to the advantage of bearish traders and it supports the possibility of prolonging the latest downward trajectory of the pair.

Traders Look to NA Session

That said, the lack of relevant economic data to be published from the UK calls for a level of caution. In the coming North American session, traders are going to take a cue from the Empire Manufacturing Purchasing Managers’ Index. It will, alongside the general risk mood, influence the Dollar and give a new momentum.

All attention would then be shifted to the UK’s employment report for the month coming up on Tuesday. It would then be closely followed by the US retail sales and production numbers. Investors would also be watching out for statements from top officials of the Federal Open Market Committee, as well as the Chairman of the Federal Reserve, Jerome Powell.

Their statements could contain indications of the coming interest rate increase and what traders should expect. It would influence the demand for the US Dollar in the short term and determine the next move of the GBP/USD pair.